Insurance plan protection is something which Anyone wants to take into account at some point of their lives, but many people forget about it right until it's much too late. No matter if you are driving an automobile, owning a home, or simply renting an condominium, knowledge your insurance policies coverage is essential to making sure that you are shielded from unforeseen money burdens. In this article, we’ll dive deep into insurance plan protection, explaining its significance, varieties, and the way to select the very best protection for your preferences. So, Enable’s discover this topic intimately!

When you think of insurance plan, the very first thing that very likely relates to head is auto insurance policies or household insurance policy. These are the most common varieties, but did you know there are numerous different kinds of insurance policies that will help safeguard you? By way of example, wellbeing insurance policy addresses clinical fees, daily life insurance coverage supplies monetary protection for your personal loved ones, and disability insurance policy supports you in the event you’re unable to do the job. With countless solutions obtainable, it’s crucial to grasp what Each individual type of coverage gives And just how it applies to your lifetime.

One of several crucial aspects of insurance coverage coverage is realizing the amount safety you may need. For example, for those who’re renting an apartment, you may not require just as much protection as a person who owns a home. Having said that, you still want adequate insurance to protect your possessions in the event of theft, fire, or pure disaster. Similarly, should you individual an automobile, your protection mustn't only secure versus mishaps but will also include liability coverage in the event you're responsible for an accident that injures someone else or damages their home.

The globe of insurance coverage might be a bit overpowering, especially if you’re new to it. But breaking it down into easy phrases causes it to be much simpler to be familiar with. Imagine insurance plan as a safety Internet. If a thing goes wrong, no matter if it’s an automobile incident, a property hearth, or a professional medical unexpected emergency, your insurance policies protection acts being a cushion, assisting to soften the blow and forestall you from sinking into money spoil. Without the need of insurance coverage, you could possibly be still left to cope with the full fiscal load all on your own, which can be devastating.

10 Easy Facts About Automated Insurance Solutions Described

An additional important aspect of coverage protection is knowing your coverage’s restrictions and exclusions. It’s straightforward to suppose that coverage will address every little thing, but which is not always the case. Each individual plan has particular limits on how much it pays out for different types of claims, and exclusions that define scenarios that aren't protected. For example, a typical car insurance plan policy won't protect injury a result of flooding, or a home insurance plan coverage may possibly exclude protection for particular natural disasters like earthquakes.

An additional important aspect of coverage protection is knowing your coverage’s restrictions and exclusions. It’s straightforward to suppose that coverage will address every little thing, but which is not always the case. Each individual plan has particular limits on how much it pays out for different types of claims, and exclusions that define scenarios that aren't protected. For example, a typical car insurance plan policy won't protect injury a result of flooding, or a home insurance plan coverage may possibly exclude protection for particular natural disasters like earthquakes.Enable’s discuss rates. Premiums are the quantity you shell out to take care of your coverage coverage, usually on a month-to-month or annually foundation. Even though paying premiums is a necessary element of having insurance plan, the amount you shell out will vary considerably according to numerous components. These variables may possibly consist of your age, driving record, the type of coverage you choose, and perhaps where you reside. It’s vital that you look for a stability between paying An inexpensive high quality and guaranteeing you've suitable protection for your preferences.

When comparing unique coverage companies, It is really necessary to take into account far more than just the price. Though it’s tempting to go for The most cost effective choice, the best insurance coverage coverage isn’t normally the just one with the lowest premium. Rather, deal with finding a coverage that gives comprehensive protection at an inexpensive selling price. Be sure you evaluation what’s included in the coverage, like the deductible, the coverage limits, and also the exclusions. It's possible you'll discover that paying a slightly increased quality provides you with superior All round defense.

Understanding insurance coverage coverage also signifies being aware of when to update your plan. Daily life modifications, like obtaining married, obtaining children, or purchasing a new vehicle, can all influence the type of insurance policy you need. As an example, Should you have a rising loved ones, you might want to improve your daily life insurance policies coverage to be sure they’re financially safeguarded if something occurs to you personally. In the same way, after buying a new automobile or house, you’ll want to regulate your coverage to replicate the value of one's new assets.

One of the most perplexing areas of insurance policy is coping with promises. Should you ever end up within a circumstance the place you should file a assert, it’s vital to understand the process as well as the techniques concerned. The first step is to notify your insurance company without delay after the incident occurs. They can information you through the future ways, which can include things like publishing documentation, submitting a police report, or having an adjuster assess the damages. Comprehension this method may help cut down pressure when you’re already addressing a challenging problem.

Now, Allow’s discuss the different sorts of insurance policy protection that folks generally purchase. Car or truck insurance policy is Just about the most prevalent and needed forms of protection. For most destinations, It can be lawfully necessary to have no less than basic car insurance policy, which handles legal responsibility just in case you're at fault in an accident. Nevertheless, numerous motorists decide For extra protection, like collision or extensive insurance policy, to protect themselves in the event of a mishap, theft, or weather-similar damage.

Homeowners insurance coverage is an additional critical protection for anybody who owns residence. This kind of insurance coverage usually protects from harm to your own home attributable to fireplace, theft, vandalism, or specified normal disasters. In addition, it may protect your personal possessions and provide liability coverage if somebody is injured on your assets. For renters, renter’s coverage presents comparable defense but applies only to your personal belongings, not the composition from the building itself.

Health insurance plan is another crucial type of protection, making sure that you are lined in the event of professional medical emergencies or regime Health care needs. Well being coverage ideas could vary significantly based on the supplier, the approach, and your distinct requirements. Some options include a variety of services, while some might only include simple needs. It’s essential to carefully Examine the plans accessible to you and contemplate aspects like rates, protection restrictions, and out-of-pocket expenses prior to making a call.

When you've got dependents or family and friends who count on you economically, existence insurance policies is one thing you need to strongly contemplate. Everyday living insurance policies supplies economical security in your beneficiaries in the event of your Dying. The protection total can vary determined by your requirements and Tastes. As an illustration, expression lifetime insurance policies offers coverage for your established time frame, although total lifetime insurance policy provides lifelong protection and sometimes contains an investment ingredient.

Some Known Questions About Insurance Risk Solutions.

Incapacity insurance policy is an additional critical but generally missed method of coverage. Should you turn into briefly or permanently disabled and so are unable to operate, incapacity insurance plan presents a source of money to help you continue to be afloat financially. This can be a lifesaver for people who rely on their own cash flow to aid on their own as well as their family members. Disability insurance policies is especially essential for those who don’t produce other forms of earnings or financial savings to drop back again on.9 Easy Facts About Global Insurance Solutions Explained

Another option to think about is umbrella coverage. Umbrella insurance policies supplies added legal responsibility protection previously mentioned and further than your other insurance policies, for example automobile or homeowners insurance plan. If you're involved in a lawsuit or confront a big declare that exceeds the limits within your primary insurance plan, umbrella insurance plan might help cover the remaining charges. It’s An easily affordable way to increase an additional layer of protection for your monetary basic safety Web.

Insurance coverage coverage is an essential section of monetary organizing, and it’s something that shouldn’t be taken frivolously. Though it would feel like an inconvenience to assessment policies, pay back premiums, and monitor different coverage forms, the comfort that comes along with realizing you’re Get all the details secured is invaluable. Whether or not you're looking to protect your vehicle, house, overall health, or existence, the correct coverage coverage can make all the difference in the celebration of an surprising incident.

If you are still unsure about what kinds of insurance coverage Explore this page are best for you, it’s really worth consulting having an coverage agent or economical advisor. They can support assess your preferences and guideline you thru the entire process of selecting the ideal policies. In fact, insurance is about protecting yourself and also your loved ones, and obtaining it suitable can provide a way of protection that’s hard to put a selling price on.

In conclusion, insurance coverage protection is something which Anyone should really prioritize. It provides a security net in periods of have to have, supporting you Get better from unforeseen activities without the need of falling into money distress. With lots of sorts of insurance policies accessible, from vehicle coverage to existence insurance policy, it’s crucial that you Appraise your requirements and choose the ideal coverage Full info for your personal predicament. By comprehension the basic principles of insurance coverage, comparing policies, and being along with your protection, you can be certain that you’re safeguarded when existence throws a curveball your way.

Patrick Renna Then & Now!

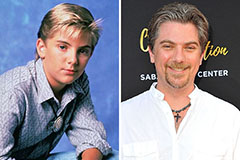

Patrick Renna Then & Now! Jeremy Miller Then & Now!

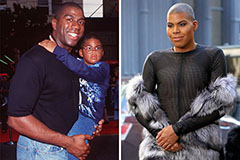

Jeremy Miller Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!